Peter Pham takes the time to share what’s been on his mind lately. Introducing Communications Director Tom Southerton. Conversation highlights include: Interpreting the struggle between risk & safety across society and markets. The role of hard assets and anticipation of omega points. Being invisible and transcending the Class War. Investing into greatness with cultural assets.The Vision: A Wall Street Bets Portolio?

1) Timing Silver: The Commodity Investment Cycle Index (CIC) is a powerful, one-of-a-kind investment indicator that forecasts the prices of commodities and their stocks. It does this by meticulously tracking the Commodity Cycle and how it affects commodity companies. And that’s a crucial tool if you’re a commodity producer, investor, speculator, or analyst. 2018 World Mining Summit

2) Shares of AMC Entertainment (NYSE: AMC) jumped 15.3% on Monday after Governor Andrew Cuomo said movie theaters could reopen in New York City on March 5. New York's reopening plan comes with some stipulations. "Assigned seating, social distancing, and other health precautions will be in place," Cuomo said.

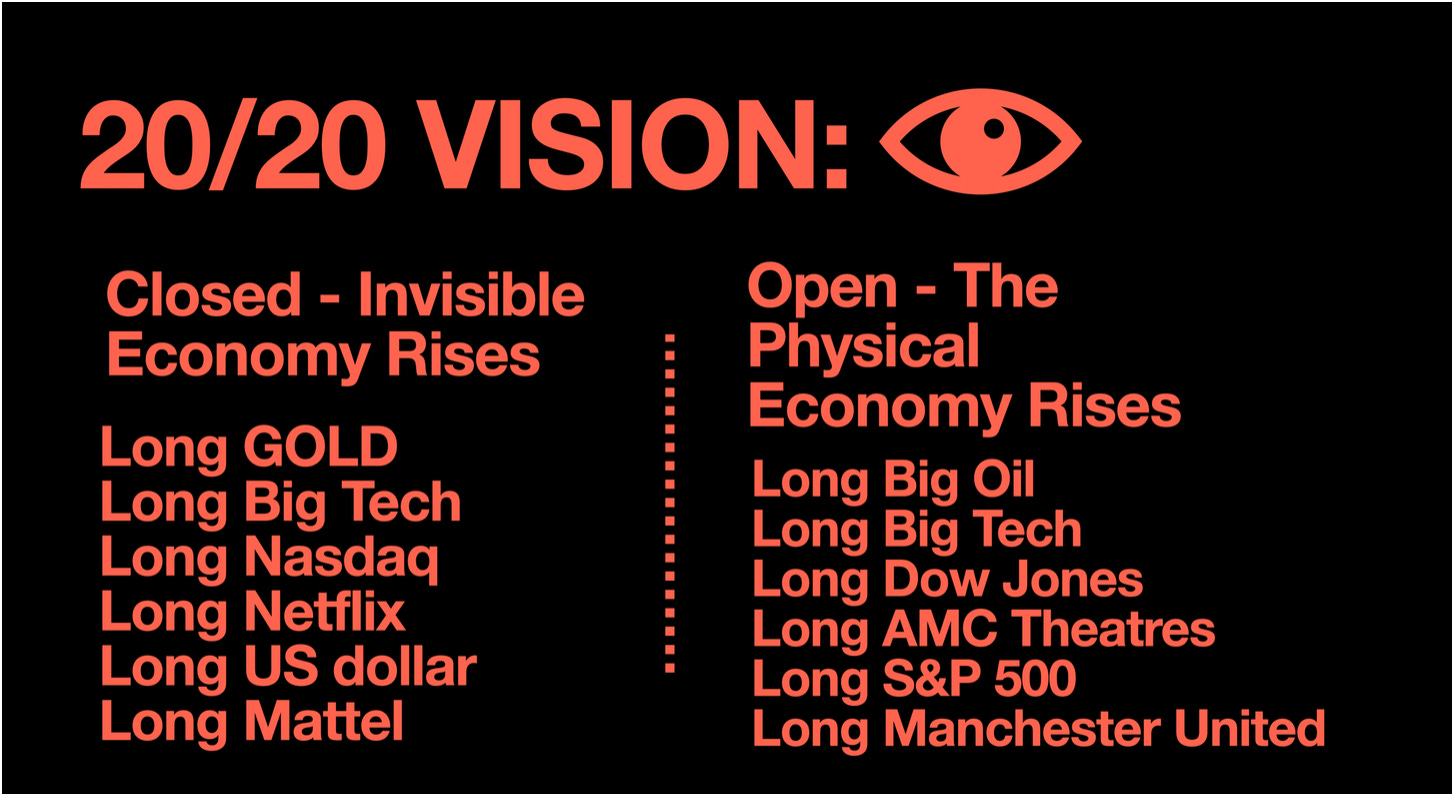

3) Vision of 20/20

Speculative Bomb

We have reached the point of polar opposites for speculations. Everything we thought we knew turned out to be wrong. Now is the most lucrative time to be focused on the unknown. It’s low cost to buy in, a chance it might not work out, but if it pays off the ROIs are explosive. As value is transformed and inverted, we will see unexpected implosions, where the known is destroyed and an increase in the unknown becoming highly valuable. Fighting the class war starts with understanding who our enemies are, then staying detached whilst investing invisibly.

REVOLUTION! The Crude Awakening

End Game: Eventually, the omega point will come when a government controls 100% of its economy. The whole process between omega points can last decades or centuries.

The Invisible Economy: Investment Zugzwang

It should be dawning on you the most important question of all. Whether the mental plane of existence is the true reality or if material scientific precepts are the true reality. Simply put, this will determine whether existence is mental or physical. Once you determine if this plane of existence is either mental or physical it will dictate how to invest in the world today. ESCAPE! The Black Iron Prison Planet

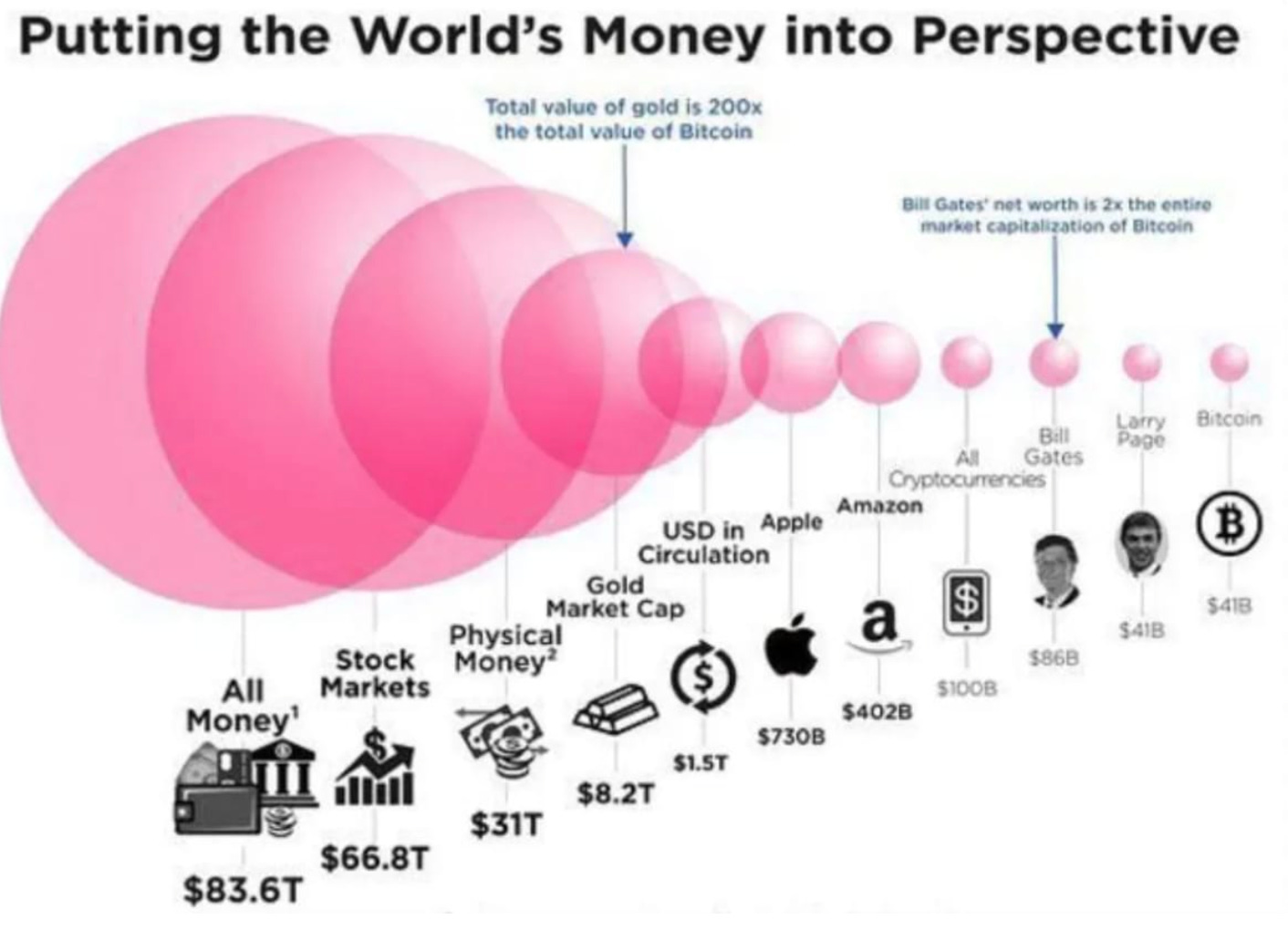

OBSERVE: all supposed ‘real’ objects are economically smaller than the subjects. The financial economy is bigger than the ‘real’ economy. We need to accept this reality and make the most of what is dealt. This is no time for social justice, this is the time to elevate your mind to the new paradigm shift.

Circulation v. Physical

Physical v. Total

Real v. Fiat

Wages v. GDP

Poor v. Rich

For those of you that tout the merits of hard assets and physical money - you're on the wrong side of history. The past, present, and future showed the systemic risk of owning real estate which is now being challenged by the technology of AIRBNB, fiat-based credit and the fiat-fueled stock market. The Death of Nations

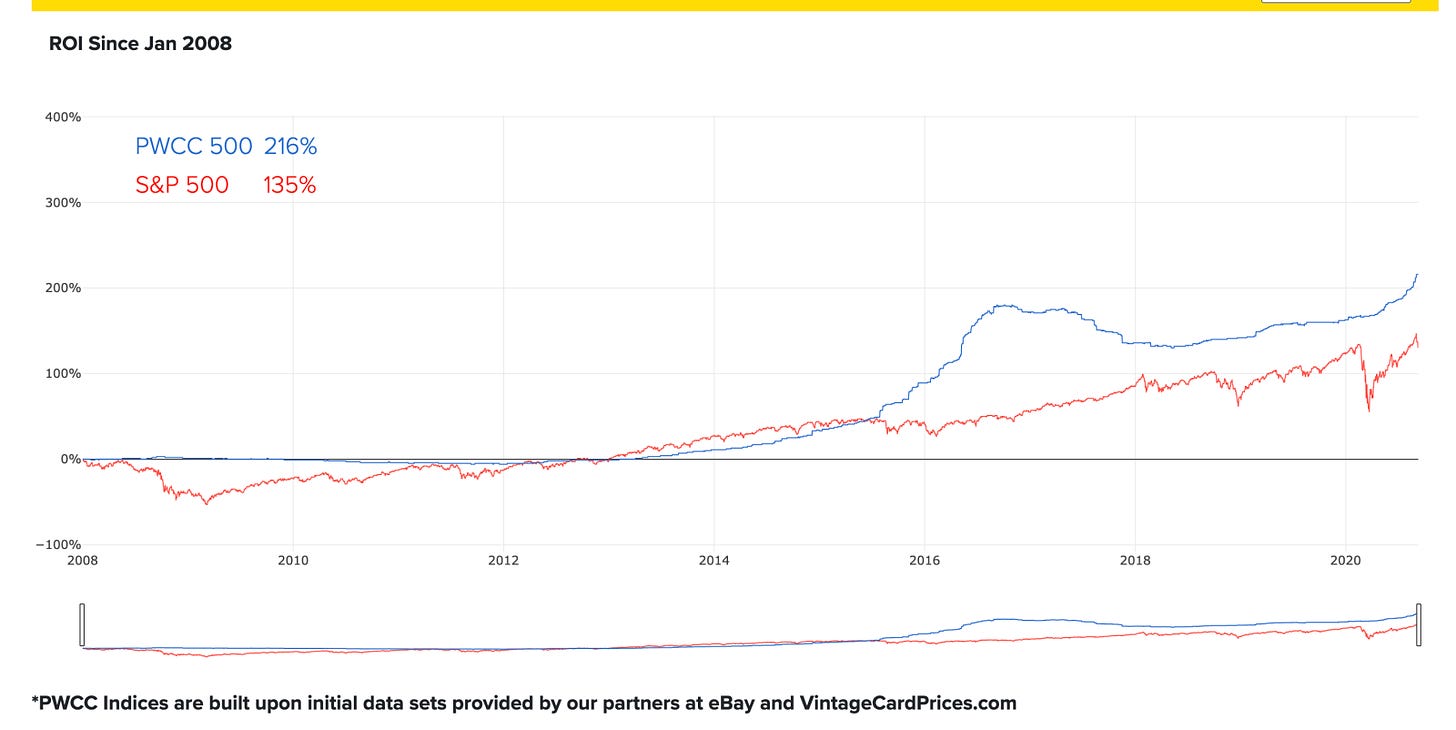

Going All In Culture

Cultural assets are going up, and they're all outperforming assets that are tied to hard elements. The physical nature of gold keeps it grounded, like the limits set by Bitcoin that grounds it from the ability to inflate with fiat money via quantitative easing, and therefore is restricting the correlation. A true hedge to the expansion of debt is actually understanding the stream of cultural consciousness. This stream is able to latch on to the expansion of debt. Hence, why the things like stocks are performing the best as they're a direct beneficiary of increasing debt.

Fiat money is undemocratic and a tool of big government. The increase of debt means the increase of the invisible. Assets that can grow with the expansion of money will thrive in these conditions. We have seen the global commitment to fully inflate, with governments and central banks doing ‘whatever it takes’ to maintain the illusion as the show must go on. The extended madness will send many who are banking on a crash to reality to madness long before the mad ones have to face reality.

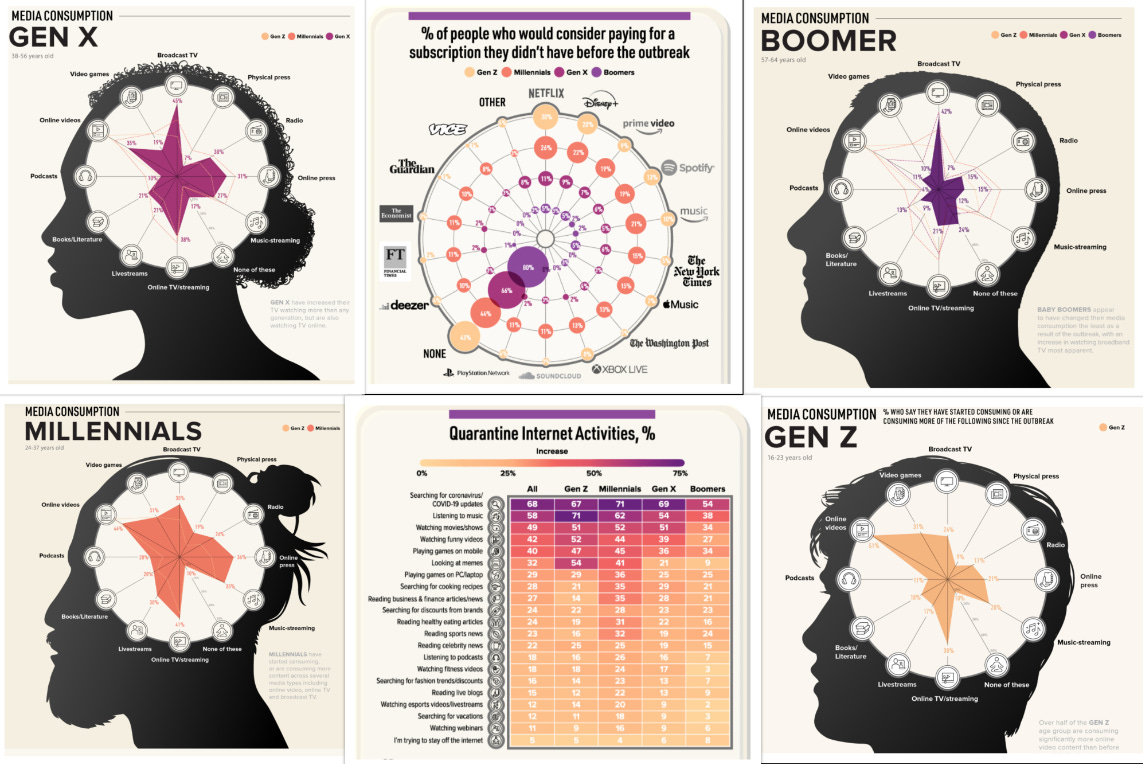

Out of this World: Think about the golden record sent out on Voyager to represent humanity in the eventuality of meeting extraterrestrial life forms. The gold itself wasn't the focus of attention, merely the best material for prolonged fidelity. NASA took a year to agree upon the playlist that included music, images and messages from around the world. Sharing our culture was the most symbolic act available to demonstrate the advancement of humankind and survive into the future. This is why governments around the world reserve hectares for cultural heritage sites and fill museums with priceless collections. The only things that remain from fallen empires of the past are their cultural artifacts, which are highly valued for providing a gateway and authenticate the stories of our cultures. The rise of cultural assets is just beginning to take momentum. We are already seeing massive moves in consumption and valuations for music, movies, streaming, podcasts, collectables, books, art, sports cards, memorabilia and related stocks. Unique experiences like live gigs, cinema and sports competitions will return and stay in demand, as the culture cycle continues to place attention on them. For some time it may seem like live vs streaming, but if live can emerge intact, the two will return to complement each other. This is the test of staying power and the building of a longer lasting culture.

The human mind by necessity shuts out a large percentage of stimuli, with a narrow band open to receive input from signals you have both consciously and unconsciously programmed. To make the most of opportunities it’s crucial to keep an open mind about the forms of culture that could perform the best. In order to thrive in the invisible economy, it's imperative to be invisible and not fit the stereotypes.

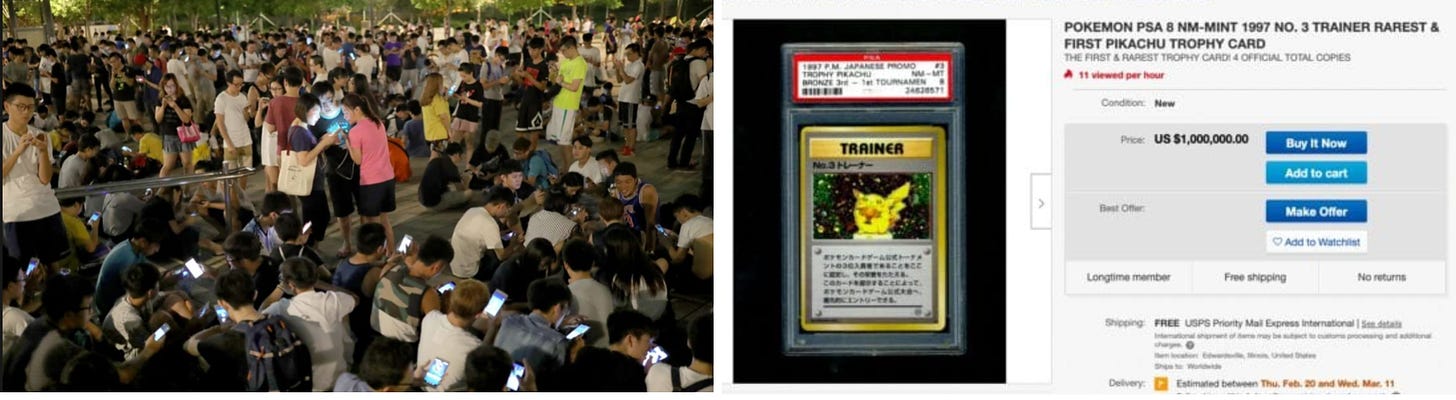

Take the example of PokémonGo, when an army of fans spent hours engrossed in augmented reality. Despite the frenzied levels of consumption we saw, with gamers literally killing themselves whilst engrossed in the game. How many bothered to invest in Pokémon cards at the time? Different segments of society identify with niche groups and have a whole range of ways to access and engage in the culture. It can be easily missed if we only identify with our own subjective cultures and mediums of choice.

Humanity’s stream of consciousness is cultural or collective thought.

Cultural assets are a gateway portal to living out and participating in the culture, an act of living. It has scaled so effectively because it is based on the minds of each individual.

We can recognize opportunities with perspectives of cultural significance and financial values, but the real question we must ask ourselves is ‘what turns you on?’.

Reply to make a move into the best assets ever!

"It is the Best Asset Ever!"